Inflation is a powerful economic force that can influence the value of various assets, including collectible items like coins. One interesting case study is the impact of inflation on Bicentennial coins, which were issued by the United States in 1976 to celebrate the 200th anniversary of the nation’s independence. Understanding this relationship can shed light on both the broader effects of inflation and the specific dynamics of the coin market.

Background on Bicentennial Coins

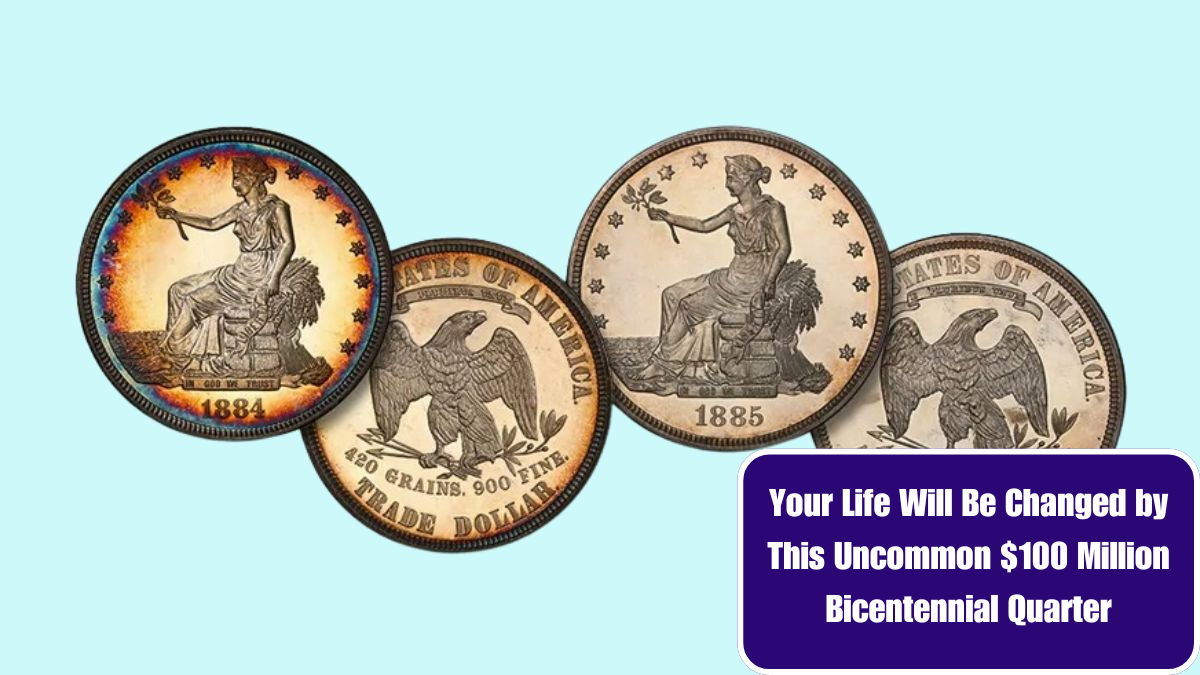

In 1976, the U.S. Mint issued special Bicentennial coins as part of the celebrations marking 200 years since the Declaration of Independence. These coins included:

- Quarter Dollar: Featuring a unique reverse design with the Colonial drummer.

- Half Dollar: Showcasing a dual design with an image of the Liberty Bell superimposed on the moon.

- Dollar Coin: Depicting a rendition of the Liberty Bell on the reverse side.

These coins were produced in large quantities and were intended for circulation, but they quickly gained popularity among collectors. Due to their distinctive designs and historical significance, Bicentennial coins have become a staple in many collections.

The Role of Inflation in Coin Values

Inflation, the general increase in prices and decrease in the purchasing power of money, has a nuanced impact on the value of Bicentennial coins. Here are several key factors to consider:

1. Face Value vs. Numismatic Value

The face value of Bicentennial coins—25 cents for the quarter, 50 cents for the half dollar, and 1 dollar for the dollar coin—remains unchanged despite inflation. However, their numismatic value, or collectible value, can fluctuate based on a variety of factors, including rarity, condition, and demand.

Over time, as inflation erodes the purchasing power of the dollar, the intrinsic value of the coins in terms of their face value diminishes. For instance, a dollar in 1976 had greater purchasing power than a dollar today. However, this does not necessarily mean that Bicentennial coins lose value. In fact, their collectible value may increase as collectors seek tangible assets that can serve as hedges against inflation.

2. Market Demand and Scarcity

The value of collectible coins, including Bicentennial issues, is often driven by market demand and scarcity rather than their face value. Despite the large production numbers, certain factors can influence their market value:

- Condition: Coins in mint or near-mint condition, particularly those that have not been circulated, generally command higher prices.

- Demand: The interest level among collectors can fluctuate based on trends, historical events, or changes in the hobbyist market.

Inflation can indirectly affect demand by influencing overall economic conditions and collector spending power. During periods of high inflation, collectors may be more inclined to invest in tangible assets like coins, which can drive up demand and, consequently, their market value.

3. Historical Significance

The Bicentennial coins are unique in their historical context, marking the 200th anniversary of the United States. Their value is not only tied to their physical attributes but also to their significance as a commemorative item. As inflation increases, historical and sentimental value can become more pronounced, potentially enhancing the coins’ appeal to collectors and investors.

Inflation affects the value of Bicentennial coins in complex ways. While the face value of these coins remains constant, their numismatic value can fluctuate based on factors like market demand, condition, and historical significance. Over time, as inflation erodes the purchasing power of money, the tangible nature of collectible coins can offer a form of stability and even appreciation for investors and collectors.

For those interested in the coin market, understanding the interplay between inflation and collectible values can provide valuable insights into both historical trends and future investment opportunities. Whether you’re a seasoned numismatist or a casual collector, keeping an eye on economic conditions and their impact on the market can enhance your appreciation of these commemorative pieces and their place in history.